Recent airfreight trends have been maintained, IATA’s latest market analysis detailing full-year results for 2019, has reported. Meanwhile, the impact of the coronavirus on the aviation sector continues to cause uncertainty for the future.

Industry-wide freight tonne kms (FTK) for the year declined by 3.3% year on year, while available freight tonne kms (AFTK) increased by 2.1% pushing load factors down by 2.6 percentage points to 46.7%.

Alexandre de Juniac, IATA’s director general and chief executive, explained: “Trade tensions are at the root of the worst year for air cargo since the end of the global financial crisis in 2009.

“While these are easing, there is little relief in that good news as we are in unknown territory with respect to the eventual impact of the coronavirus on the global economy.

“With all the restrictions being put in place, it will certainly be a drag on economic growth. And, for sure, 2020 will be another challenging year for the air cargo business,” he said

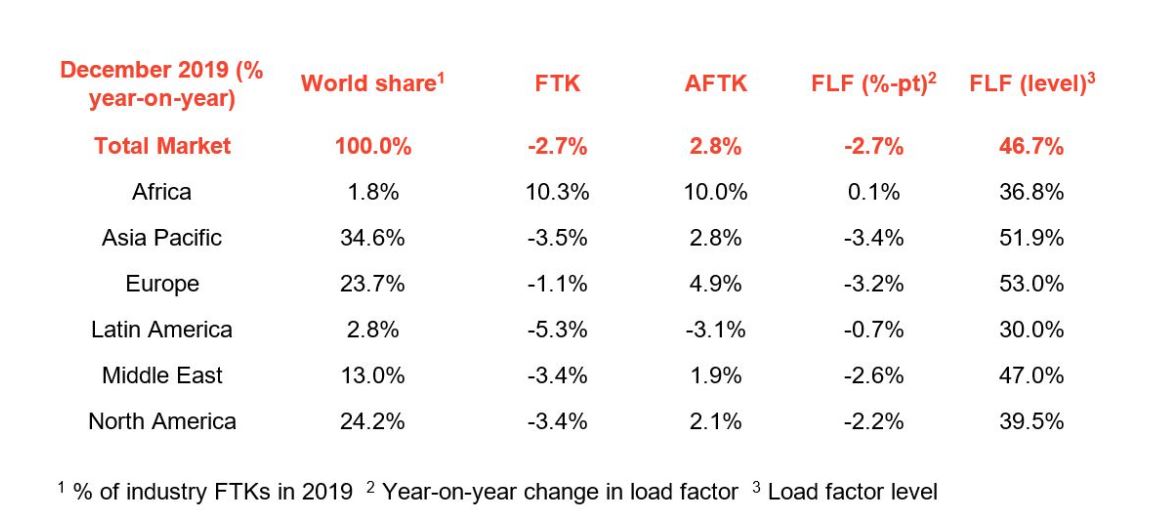

In December 2019, freight volumes ended the year on a “weak note”. Industry-wide FTKs for the month declined by 2.7% year on year, while capacity rose 2.8%. Load factor lessened by 2.7 percentage points in December 2019, compared with 2018, to 46.7%.

IATA suggested that various factors contributed to the underperformance of air cargo in 2019, including global trade wars which slowed down demand growth by impacting trade. In addition, IATA reported that “a number of manufacturing sectors where airfreight is relied upon for the timely distribution of spare parts and high-value inputs, experienced weak demand conditions”.

Although IATA believes demand will eventually pick up in 2020, it said: “it is too early to say what long-term effects will be seen from the impact of restrictions associated with combatting the coronavirus outbreak”.

Looking at regional performances, volumes of Africa-based airlines in December increased by 10.3% year on year and for the year improved by 7.4%. Capacity in December also grew by 10% and for the entire year of 2019, increased by 13.3%. During the past year, investment from Asia helped to bumped up the region’s growth.

For airlines based in the Middle East, volumes in December decreased 3.4% year on year and capacity increased by 1.9%. Overall in 2019, the region experienced a 4.8% decline in demand and capacity dipped 0.7%. IATA suggested that “disruption to global supply chains and weak global trade, together with airline restructuring in the region”, impacted the region’s outcome.

Asia Pacific-based airlines experienced a 3.5% decrease in growth in December, compared with the same period a year earlier. Capacity meanwhile increased by 2.8%. Overall 2019, volumes in the region slid 5.7%, while capacity increased by 1.1%. Trade wars and tensions are believed to have negatively impacted the Asia Pacific region’s performance.

Europe-based airlines’ volumes declined by 1.1% year on year in December and capacity rose by 4.9%. For the year there was a 1.8% drop off in demand.

Meanwhile, North America-based airlines saw volumes fall by 3.4% in December, while capacity grew by 2.1%. For 2019 in total, the region’s cargo volumes declined by 1.5%. “Trade tensions and cooling US economic activity in the latter part of the year have been factors in the decline,” IATA reported.

Latin America-based airlines suffered the sharpest fall in decline in December, of 5.3%. The region was also the only one to see a reduction in capacity – down by 3.1%. For the year, there was a 0.4% decline in demand.

Article at AirCargoNews

Leave A Comment